low cost refinance options compared for today’s homeowners

What “low cost” really means

A true low-cost move focuses on more than the sticker price. Watch the APR, credits, and whether fees are rolled into the loan. A slightly higher rate with lender credits can beat a rock-bottom rate stuffed with points, especially if you’ll move or sell within a few years.

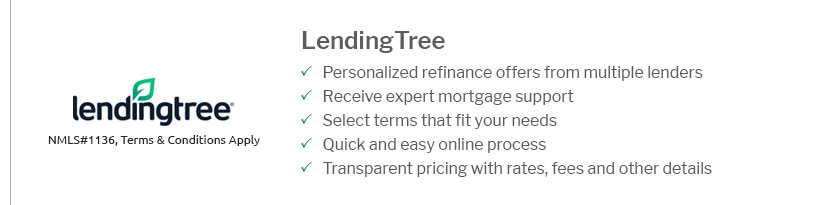

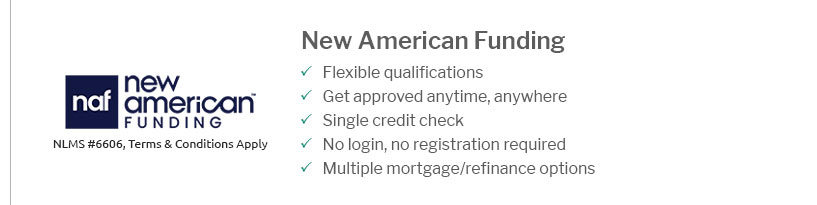

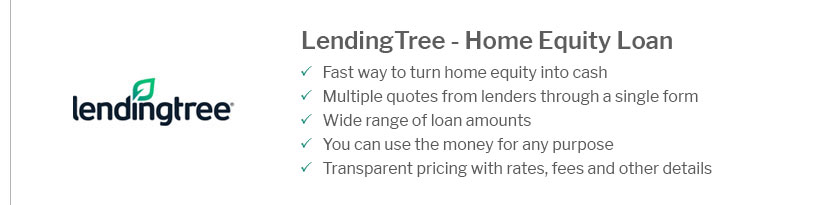

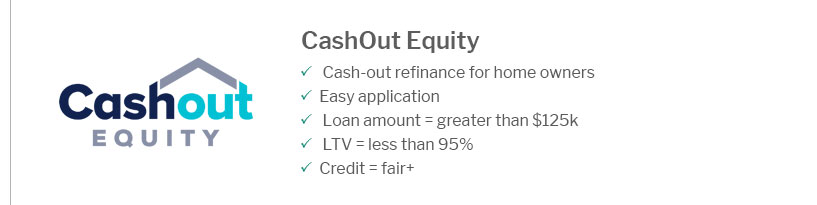

Popular options at a glance

Here’s how common choices stack up when you want savings without surprises. Each has trade-offs in speed, paperwork, and long-term cost.

- No-closing-cost refinance: Lender pays fees for a modestly higher rate; great for short horizons or quick breakeven.

- Shorter-term refi (20 or 15 years): Usually lower rates and faster equity build, but higher payments; shines if cash flow is strong.

- Streamline refi: Minimal docs for eligible loans; fast and simple, yet fewer chances to shop costs.

- Cash-in refi: Bring funds to drop PMI or hit better pricing; strong choice when savings outpace lost liquidity.

How to choose

Compare three quotes on the same lock period, run a break-even analysis, and stress-test payments. When in doubt, prioritize flexibility and total cost over headlines.